Return of the Developer

- Anthony Kavanagh, Portfolio Manager

- Jan 9, 2023

- 14 min read

Updated: Mar 16, 2023

“Ten years ago we were saying that the 15 to 20-year timeline was looking bleak. Now we’re saying, ‘Oh boy, in 5 to 10 years, things can get rough. Investment needs to increase and it needs to increase beyond what we were spending during the last boom in exploration”

— Kevin Murphy SandP Global Commodity Insights Analyst, March 2022

Last month the world witnessed Lionel Messi lead Argentina to a famous World Cup victory in an air-conditioned stadium in the Qatari desert, midway through the European football season. If ever there was an endorsement that anything is possible with willpower and the right (government) support aka funding, it’s Qatar hosting the 2022 World Cup. The task seemed almost insurmountable when announced but Qatar was able to construct 7 stadiums over the course of 12 years with a reported price tag (for the entire event) of USD220bn, changing almost 100 years of football history in the process.

Bill Shakly once famously quipped "football isn’t a matter of life and death... it is much more important than that". And as we sit here today, looking forward 12 years, Benchmark Minerals are estimating we need to construct over 380 lithium, nickel, cobalt and graphite mines (plus plenty more copper & rare earth mines, plus other infrastructure) to fuel the world's energy transition, requiring not billions but trillions of dollars, in an issue of similar importance to football. Refer below for a fantastic visual.

Source: Benchmark Minerals Intelligence, for further info contact info@benchmarkminerals.com

We don’t want to labour a point that has been well covered but it is obvious we are in a new era for mining as the energy transition theme moves from mainly a China story to a whole of world story. With this note we revisit a paper we wrote 2 years ago titled Return of the Explorer (“ROTE”) where we theorised the energy transition was one of multiple factors that could be leading to an upcycle in commodity exploration. We further expand on the premise we need more exploration with the statement we urgently need more development as the supply side of the equation is looking challenged. Notably the grey line, in the graph below isn’t a trend line but a separate data source. It shouldn't take a degree in data analytics to identify that exploration and development capex are highly symbiotic!

Sources: Chester Asset Management, S&P Global Intelligence and GlobalData, refer section on Lycopodium for copy of GlobalData graph this data relates to.

There are multiple ways to play this needed development boom and we explore this in five categories below.

Exploration companies

Single (and multi) mine development companies

Development contractors

Non energy transition commodities (sounds counterintuitive but we explain below)

Production enhancing opportunities

Exploration Companies (Update)

In ROTE, after the drawdown in 2020 we theorised we were in the early innings of an exploration boom that could replicate previous upcycles. Under this premise we expected exploration companies such as Imdex (IMD) and ALS Limited (ALQ) to benefit with increased revenue (top-line beats) and operating leverage (margin beats). Although the path hasn’t necessarily been smooth for those names, that thesis has played out. However, 2 years into a cycle we thought might last for at least 4 years S&P are now calling for 2023 global exploration expenditure to decrease by 10-20% before recommencing its upward trajectory into 2024. Despite the weight of evidence that rapid development and exploration is needed[1], arguing with S&P’s latest analysis here might be somewhat futile[2].

The reasoning we are guessing is the US/global recession expected in 2023. That was the same explanation given to us by others when IMD and ALQ both experienced share price pullbacks in 1H CY22. We have hence included a graph of US GDP growth vs global exploration to investigate the relationship between the two. Note with only annual exploration figures we lack data points for a regression analysis but agree that the GFC and COVID did align with down years in exploration expenditure. However, the prolonged downcycle from 2013 to 2016 was in spite of a period of reasonable US GDP growth of ~2% so the relationship between exploration and GDP seems somewhat spurious.

Source: Chester Asset Management with data from S&P Global Intelligence, Trading economics

Outside of S&P, which we said we wouldn’t argue with, one of the more recent datapoints came with Major Drilling’s Q2 FY23 results[3]. While they acknowledged a “slight softening in activity from the junior miners” they further noted that “customer demand for CY23 looks to remain strong… (and) the growing supply shortfall in most mineral commodities continues to drive demand for … (Major’s) services”. Hence, we believe if S&P are accurate in their projection for CY2023 it would most likely be more evident in the second half.

Digressing back to the football analogy with a quote from one of the game's most iconic leaders Ted Lasso "There's two buttons I never like to hit: that's panic and snooze". We feel that pausing exploration and development now would be like hitting the snooze button the day of a life changing meeting and it may require more than a few shots of strong coffee to recover from. Hence despite us finding S&P’s projection pessimistic we have aligned our global exploration model to this ~15% drop in CY23 to ~USD11bn before recovering to ~USD13bn in CY24 (CY22 levels). It is there the panic button may be hit and we expect the upcycle to continue and likely accelerate. For reference we demonstrate what this scenario, and recent trading might imply for IMD and ALQ below.

IMDEX

Below is IMD’s historical half year revenue, translated into USD, updated to 2H FY2022.

Sources: Chester Asset Management, Imdex results announcements, S&P Global Intelligence

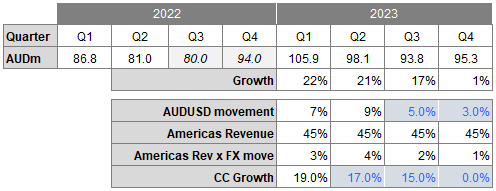

In October 2022 IMD reported Q1 FY23 revenue of AUD106m representing growth on pcp of 22%, or 19% in constant currency. We assume that growth rate has continued into Q2 and IMD can deliver 1H revenue >AUD200m. Where revenue lands in 2H FY23 (1H CY23) is the million-dollar question but notably, per above there aren’t many instances of a negative 2H after growing double digit 1H or material drops (in AUD revenue) after double digit 1H growth (2H FY15 in USD the starkest). Furthermore IMD’s recent AGM announcements included comments that resource companies are maintaining or increasing their exploration budgets and that drilling contractors have “strong order books”, with most regions described as “strong” or steady”. This compares to the commentary accompanying the 1H FY16 results of a “Decrease in exploration expenditure in key markets”. Chester FY23 projections are presented below[4].

Source, Chester Asset Management, Imdex AGM announcement

Assuming our number in 1H FY23 is close, it implies 2H consensus revenue of ~AUD170m which would represent a -17% half on half (h-o-h) decline. We project ~AUD190m revenue in the 2H and even feel that is somewhat inconsistent with AGM commentary. Hence see room for a revenue beat in FY23. We further assume with recent acquisitions and lower level of junior exposure vs market (15% vs 40%) ex Blast Dog IMD can maintain a market share slightly higher than our 2022 calculation[5] at 2.1%. This has recently proven[6] and could continue to prove too conservative an assumption due to acquisitions, mix or a range of other factors.

Source: Chester Asset Management with data from S&P Global, IRESS and Imdex results announcements

We have tried to reflect this USD revenue market share in projections out to FY25 noting the high degree of uncertainty in these projections.

Source: Chester Asset Management

To the base revenue scenario projections we further add Blast Dog revenue and show what they imply vs consensus below. Refer Blast Dog Example below for more details.

Source(s): Chester Asset Management, IRESS

Without being too cute with our projections, using the S&P scenario and assumed market share level we can see potential for a revenue beat in FY23, meet/miss in FY24 but a material beat in FY25, particularly if Blast Dog is successful.

ALS

As a refresher, exploration (‘Commodities’ division) currently only represents ~40% of ALS Limited (ALQ’s) revenue. At ALQ’s recent 1H FY23 result Commodities revenue grew at a very impressive 31%[7] with EBITDA margins expanding by 191bpts to 36.3%. It affirmed our belief of the operating leverage achievable in an upcycle.

Not to take away from the strong result, it has notably been buoyed by junior miners representing ~40% of current volumes[8]. Sample volumes in Geochem were up 17% vs pcp, with organic revenue growth of 31.4%, I.e. price/mix benefit of ~14%, driven by growth in junior samples. Furthermore, Q2 sample growth slowed to 11%, following 22% in Q1. Although the market isn’t necessarily projecting growth to sustain, and ALQ appear to have picked up market share, the evolving softening in junior exploration is something to be mindful of. As has been recounted to us by industry participants there is still ample demand from intermediaries and majors as juniors slow so even if volumes are stable there may be a reversal of recent mix benefits.

We have performed a similar exercise to IMD to project ALQ Commodities earnings. Based on this exercise we see potential for ALQ to exceed market expectations in FY23, however under the S&P’s 10-20% 2023 drop scenario, we believe it implies risk to FY24 before recovering to a reasonably in line FY25.

Source: Chester Asset Management, ALQ results announcements

Sources: Chester Asset Management, Various anonymous broker reports

The Development = Alpha phase of a mining project

Recently we have witnessed a host of ASX developers[9] undertake capital raisings prior to declaring commercial production. Justifications are aplenty including the need to “accelerate” and derisk developments. Hence it begs the question why invest in the ‘risky’ development phase of a project with the threat of overruns and dilutive equity raisings? The answer lies in the telling image below, essentially a Lassonde Curve[10].

Source: The Visual Capitalist

What the image illustrates, is that there is actually a material derisking period during development for key mining projects that leads to share price outperformance. Bellevue Gold (BGL) a single, gold mine developer that is <12 months from production has provided an interesting backdrop to this with reference to 5 of the more successful recent single, gold mine developments.

Source: BGL Macquarie Presentation, November 2022

We have tabled the key statistics of these companies below and expanded on the data to also include the share price performance of these companies 3 and 12 months post declaring production.

Sources: Chester Asset Management, BGL presentation material, IRESS

Conscious the BGL list represents a somewhat favourable sample, we have added to it, but focused exclusively on ASX names.

Source: Chester Asset Management, BGL presentation material, IRESS

As a demonstrative example rather than a complete universe this list only includes gold companies (we are supposed to be on holidays). However, we are conscious of biases inherent within this analysis including survivorship bias. We believe focusing on gold developments is worthwhile as a tried and tested commodity so reflective enough of the value add of developments. For context we have provided a sample of other ASX commodity developments below.

Source: Chester Asset Management, BGL presentation material, IRESS

Notwithstanding the biases it demonstrates to us a few interesting points:

There is a genuine (alpha) opportunity to invest in companies within the development phase of a project

For those select names in our sample that didn’t generate alpha the drawdown is actually quite small, even for companies that were later proven to be unsuccessful developments!

The re-rate potential of development far exceeds that of production, I.e. on average there isn’t necessarily much benefit in holding these companies once into production (Lassonde Curve agrees with this)

The return from this development phase can actually be greatest in riskier jurisdictions, i.e. WAF, ROX, EMR, TIE

Hence we believe it worth considering factors that may make one company more successful in the development phase than another:

Management development experience

Contractors utilised and terms of contracting - fixed price, lump sum, etc.

Development type - brownfields or greenfields?

Balance sheet strength

Portfolio diversification

Flow sheet complexity

Preparatory works including resource definition drilling and mine plan

Pre-development NPV discount

With increased prevalence of single mine companies and the outcome of the samples above it presents as a reminder not to ignore all companies entering the development phase of a mining cycle. Tabled at the end of this article are some of the development opportunities that exist on the ASX (mainly single mine but some multis). We have further highlighted some of the companies within our portfolio and on our watchlist we are watching more closely. In alphabetical order: ADT, AMI, BGL, CHN, COI, DEG, DVP, GMD, INR, JRV, LLL, NXG, PMT, STX/WGO.

One thing we will highlight here though in relation to the lithium names is the re-emergence of direct shipping ore, also referred to as DSO. This was a feature of the last mini lithium boom of 2017/2018, when at the time MIN were the innovator shipping DSO from Wodgina accompanied by PLS shipping Pilgangoora DSO. This time around there is no shortage of companies lining up to espouse the merits of DSO. Given: the lengthy time to commercialization, the strong demand and the spare capacity available in China to process and concentrate lithium it makes complete sense that aspirants would want to access this early form of project funding. Core Lithium (CXO) were one of the first movers this boom, last month shipping 15k dmt of 1.4% DSO at a price of USD951/dmt CIF tendered via an auction that reportedly attracted 30 bidders. In addition to CXO; GL1, RDT, LLL and WIN are just some of the names we have heard from recently investigating the option of DSO. The discussion was also followed with the commentary in many cases “we see no reason lithium prices should soften in the near term”. Hence DSO remains an area we are cautiously watching as well as near term Chinese demand.

Development Contractors

As we pointed out in ROTE one way to play this kind of thematic is a pick and shovels approach. I.e., invest in companies leveraged to development. Tabled below are some of the key ASX names that fits this criteria.

Sources: Chester Asset Management, various company announcements

WORLEY PARSONS

We have investigated Worley Parsons’ (WOR’s) past results for what a future boom might infer for earnings; however, it is challenging given WOR's heavy exposure to hydrocarbons which have largely seen declining development. The task is made even more complicated by multiple material acquisitions, segment reclassifications, corporate cost reclassifications, accounting changes and cost rationalization programs. Despite this we believe there is a level of operational leverage available as we enter into a boom period for sustainable developments. At the very least however WOR currently show that margins on sustainability work is undertaken at more favourable margins (35-40% higher[11]) than traditional work so theoretically benefits from mix shift as the book becomes more sustainability weighted.

Source: WOR FY2022 Results Presentation

There are arguments for and against the sustainability of sustainability margin premiums however we also believe there is opportunity for margin expansion (leverage) in traditional project work as demand ramps up to mitigate ‘lost’ Russian hydrocarbons. However, without making a call and assuming the margin differential is maintained and consensus revenue is reasonable[12] there is reason to expect an upward bias to market’s expectations for future margins as we show in the table below.

Source: Chester Asset Management based on WOR data in FY2022 results presentation

LYCOPODIUM

We also completed analysis on Lycopodium’s (LYL) past results as a relative pure play in resource project developments. The graph below[13] represents a reasonable guide to global development capex and hence the environment in which LYL have operated in. If exploration does drop by 10-20% in 2023 we would expect a similar decline in development in 2023/2024 but outside of that, similar to exploration we would expect a reasonably swift recovery in development expenditure given the increasing urgency to satisfy transition demand.

Based on the following graph Lycopodium has traditionally achieved 0.15-0.30% of the capex of the 20 leading miners 2010-2022, average ~0.25%.

Sources: Chester Asset Management, Lycopodium historic results, GlobalData

Sources: Chester Asset Management, Lycopodium historic results, GlobalData

Although a small sample size the data suggests stronger margins during the upcycle of capex periods. As we demonstrated in ROTE this could provide opportunity for upside surprise on margins (as well as top-line surprise) in a development upcycle.

Non-Energy Transition Commodities

Capital is scarce and in a world of declining liquidity becoming scarcer. This is evident in the relative multiples the market is prepared to pay for non-energy transition (NET) commodities. The lack of capital being afforded to NET commodities has and will continue to create opportunities. At the extreme ends of the scale governments are now providing backing to select projects to assist in their development: Refer the loans program of the US Inflation reduction act (IRA) 2022[14] and the recent award of USD2.8bn in grants via the Infrastructure Bill to boost US production of EV batteries and associated minerals including up to USD220m to Syrah (SYR). Or closer to home the Australian Government's AUD1.05bn non-recourse loan to Illuka (ILU) to assist in the construction of the Eneabba Rare Earths refinery. On the alternate side of the ledger many banks including Australia’s Big 4 have ceased lending to coal miners and governments globally are imposing price caps on oil and gas, dislocating markets and stunting their development. Not covering any revelationary grounds we think this differential in costs of capital will continue to see an underinvestment in hydrocarbons and provide long term support for coal and oil and gas prices. We aren’t sure that is necessarily reflected in long term consensus oil price forecasts of USD65-70/bbl.

We believe a similar phenomenon to the underinvestment in oil and gas may be occurring in precious metals, particularly the gold mining space where globally multiples have contracted, production has recently been declining, reserves depleting and grades reducing. Despite recent strength in the USD, the gold price is back around 2011 highs and yet gold miners are trading at multiples akin to trough periods like the GFC. This is despite unprecedented strength in gold miner balance sheets, record share buybacks and healthy dividends. We believe this could provide the backdrop for a strong period of gold performance and for gold miners to rerate.

Sources: Chester Asset Management, Bloomberg

Recovery Optimisation

Given the imperative to extract more commodities than we have historically, beyond mine development there is also opportunity for resource recovery optimisation. 2 key areas that stand to benefit are:

Recycling. Neometals (NMT) is the key name here we believe that stands to benefit from transition metal recycling but at this stage we are unsure of the business model they will eventually utilize. Sims Metal (SGM) may also benefit however we are unsure of their ultimate exposure to energy transition metals.

Technology providers. There are a host of technologies eloquently referred to as ‘precision mining’ tools which have the benefit of extracting more metal with less waste. Forms of precision mining include but are not limited to: Ore sorting technology, Autonomous trucks (SVW), Novel assay services (C79), Orebody intelligence and mining optimisation (RUL, ORI, IMD, PRN), Blasting solutions (ORI, IMD).

BLASTING SOLUTIONS - BLAST DOG (IMD) EXAMPLE

For those uninitiated Blast Dog is a commodity agnostic, semi-autonomously deployed blast-hole sensing and measurement technology providing real time orebody knowledge for logging material properties and blast hole characteristics. It can facilitate improved blast designs and optimize explosive costs. It also enables IMD to enter the mining production space, providing revenue away from purely exploration, enhancing the visibility and reducing the cyclicality of future earnings.

When we first invested in IMD in late 2019 part of our thesis was the material upside from new technologies: Corevibe, Xtracta, Maghammer and Blast Dog. Over the past 3 years the lack of progress with this new tech has disappointed with these technologies, ex Blast Dog now largely written off. On face value 3 of the 4 technologies ceasing would presumably mean the majority of future upside diminishing but the reality is[15] Blast Dog was by far the most material and accounted for ~2/3 of our upside assessment. In contrast recent Blast Dog progress has hence been pleasing and we found the latest AGM updates encouraging, in which IMD reported an acceleration of Blast Dog’s roll-out at Iron Bridge. Additionally, the fact there are now 6 commercial prototypes planned for FY23 (and multiple more opportunities in the pipeline) highlights momentum with the technology.

Source: IMD FY2022 AGM Presentation, October 2022

Although yet to claim Blast Dog a guaranteed slam dunk, these updates arguably point to higher probability of commercial success and partial derisking of the success case in our valuation.

Source(s): Chester Asset Management, Imdex announcements

Closing

Whether the projected dip in exploration expenditure eventuates in 2023, analysis is clear that the world is nearing an inflection point in the development of energy transition metals. We trust this has provided some insights into the opportunities available from this potential boom and hope despite S&P’s forecast, 2023 can be a year of development for us all and our football teams.

Appendix – ASX Explorers / Resource Delineation and Development Plays

Sources: Chester Asset Management, various company announcements

[1] As S&P’s own analyst, Kevin Murphy per the introductory quote stated not less than 12 months prior

[2] We do point out though that the gold price has rallied over 10% since S&P’s analysis which may be one reason to reconsider the expected decline

[3] Quarter ending October 31

[4] FY22 Q3 and Q4 are estimates, Currency assumes ~spot for the remainder of the year

[5] But we may be wrong on IMD revenue and global exploration spend here.

[6] In 2020 and 2021 market share appears to have increased 20bpts and 10bpts respectively

[7] In Constant Currency

[8] vs IMD ~15% of volumes being from Juniors

[9] BGL, JRV, MCR, RED, MCR, PNR, TUL, STA (April 2022)

[10] Which is reused from ROTE

[11] Based on measuring graphs in WOR FY2022 Results material, assumes graphs are to scale

[12] To which we see upward bias

[13] Which we have relied on for the data in the first graph but

[14] (VIEW LINK)

[15] from an investigation of TAM, customer proposition and potential price